By Mufti Zameelur Rahman

Zakāt is a central pillar of Islām and one of the primary acts of worship alongside ṣalāh, fasting in Ramaḍan and Ḥajj. Thus in light of the Qur’ān and Sunnah and the spirit and objective of Sharī‘ah, the jurists (fuqahā’) of the ummah have carefully articulated the legal philosophy of, and rulings related to, Zakāt. Detailed chapters in the works of jurisprudence (fiqh) in each one of the recognised schools of law (madhhabs) provide us with a distilled, holistic and clear view on the scope and purpose of Zakāt.

There have been calls from certain quarters to revise our basic suppositions about Zakāt: that its ultimate purpose is the alleviation of poverty or the purification of Zakāt payers. It has been argued that a basic part of the philosophy of Zakāt is that Zakāt money be spent locally, and that in this and other respects it is more akin to a government tax. It has thus been suggested/argued that Zakāt should not even be given to poor relatives or those in more need if they are from another part of the world.

This philosophy of Zakāt is at odds with the understanding of the Ḥanafī school. The following has therefore been written to provide a basic outline of the Ḥanafī understanding of the purpose and legal philosophy of Zakāt.

Helping the Needy

From a legal standpoint, according to the Ḥanafī school, Zakāt is essentially a poor-due with the primary purpose of alleviating poverty. Although localised distribution of Zakāt funds is encouraged, it is not because of anything intrinsic to the nature of Zakāt. Ḥanafī jurists have clarified that this encouragement derives from the right that those who live in the vicinity of Zakāt-payers have on account of physical nearness to them. Because the primary focus is on need and poverty, jurists have clearly stated that there is no reprehensibility in distributing Zakāt outside of one’s locality when there is greater need – and in fact, this is encouraged.

Hence, according to Ḥanafī legal philosophy, the categories of Zakāt recipients mentioned in verse 9:60 of the Qur’ān are as a general rule given charity (ṣadaqah) with the ultimate purpose of alleviating poverty (faqr) and need (ḥājah). Ḥanafīs draw their understanding from the ḥadīth of Mu‘ādh (raḍiyallāhu ‘anhu) in which the Prophet (ṣallallāhu ‘alayhi wasallam) instructed him in the late ninth or early part of the tenth year of Hijrah, when dispatching him to Yemen, to take Zakāt “from their rich and return it to their poor.” Hence, Zakāt payers are the “rich” and Zakāt recipients are the “poor”. In a similar ḥadīth, Ḍimām ibn Tha‘labah asks if Zakāt is taken from the rich and given to the poor, to which the Prophet (ṣallallāhu ‘alayhi wasallam) replies in the affirmative – this also took place towards the end of the ninth year of Hijrah.[1] These are two famous ḥadīths found in most of the famous collections.

There are two categories mentioned in verse 9:60 of the Qur’ān that do not fit this legal philosophy, and thus Ḥanafī jurists have provided explanations for them based on the madhhab’s overall understanding. These two categories are as follows:

- Zakāt collectors (‘āmilīn) appointed by the Islāmic government. Since a condition of Zakāt is that it is given to the poor, Ḥanafī jurists explain that what Zakāt collectors receive is not “as Zakāt” (lā bi ṭarīq al-zakāt), but as “wages” or “payment”. Hence, only the Khalīfah has the right to give it to them, while one giving Zakāt on his own may not do so.[2] In other words, if Zakāt collectors were true Zakāt recipients, anyone paying Zakāt should have been able to give it to them. But since they are not true Zakāt recipients, this is not the case. Rather, they are given payment for their work by the ruler of an Islāmic government who, as a representative of the poor, pays them from the Zakāt funds they collect.

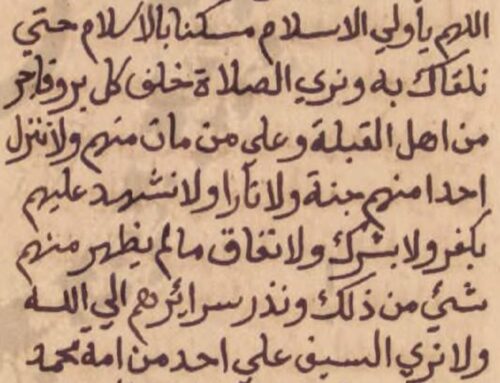

- “Those whose hearts are reconciled” (mu’allafatu qulūbuhum). According to the Ḥanafī understanding, this category only existed in early Islām[3] with the purpose of disinclining individuals from harming Islām and the Muslims. In the early phase of Islām, until approximately the ninth year of Hijrah, Islām and Muslims faced an existential threat. It was realistically possible for the non-Muslim powers surrounding the Muslims to annihilate Muslims and Islām. However, with the victory of Ḥunayn and Tabūk, and the subsequent delegations of people who accepted Islām in droves, Muslims had become powerful and their numbers had increased to the point that there was no longer an existential threat. It is at this point that “those whose hearts are reconciled” ceased to be Zakāt-recipients. Hence, in the two famous ḥadīths mentioned above, Zakāt is mentioned as being “taken from the rich” and “given to the poor” with no category in between. If the “reconciled” are presumed to be rich, this would be in apparent conflict with this ḥadīth. Hence, some Ḥanafīs have suggested that it is these words of the Prophet (ṣallallāhu ‘alayhi wasallam) that abrogated this category.[4] Moreover, even when this category was operational, just like the category of “Zakāt collectors”, it was only the ruler, having received the Zakāt funds for the poor, who could then pay it to the “reconciled” on their behalf; hence, the legally poor remained the only true recipients.[5]

Imām al-Qudūrī (362 – 428 H) explains that based on the clear wording of the ḥadīth, there are two categories of people: Zakāt payers who are “the rich” and Zakāt recipients who are “the poor”, with no category in between. He then states: “If it is argued that there are other categories by agreement, namely the collector, those whose hearts are reconciled and the traveller, we reply: The collector is not deserving of Zakāt but only takes it as payment, the reconciled have been abandoned, and as for the traveller, he is a poor person in the place in which he is in.”[6]

‘Alā al-Dīn al-Samarqandī (d. 539 H) explains: “Zakāt may be given to those who fulfil some conditions. One of these [conditions] is poverty (faqr) since it is not permitted to give Zakāt to the rich. The statement of [Allāh], ‘charities are for the poor…’ (9:60), is a command to spend on the eight categories. These [categories] were mentioned to clarify the subject of spending in terms of need…However, the scriptural text (i.e. verse 9:60) has become abrogated (mansūkh) with regards to those whose hearts are reconciled according to us. As for the collector, what he is given is wages for his work, and [it is not given to him] as Zakāt (lā bi ṭarīq al-zakāt). This is why when a possessor of wealth carries his wealth on his own to the Khalīfah, he does not give the workers any of the Zakāt…”[7]

Imām al-Mawṣilī (599 – 683 H) says: “It is based on the cause of poverty and need that [those entitled to Zakāt] have become recipients. The purpose [of Zakāt] is to enrich the poor and fulfil the need of the needy. He (upon him peace) said: ‘Take from their rich and return it to their poor.’ This is why it is not permitted to distribute [Zakāt] to the rich of these categories. Thus, it is realised that the purpose is repelling need which is the characteristic extending to all [categories]…as distinguished from the collector [appointed by the Islāmic government], as he [alone from these categories] does not take it as charity but rather in exchange for his work.”[8]

Imām Abū Bakr al-Jaṣṣāṣ (305 – 370 H) says under the tafsīr of verse 9:60 in his Aḥkām al-Qur’ān: “All those who receive Zakāt from these categories only do so as charity on account of [their] poverty…We only say this because the Prophet (Allāh bless him and grant him peace) said: ‘I have been commanded to take charity from your rich and return it to your poor,’ and thus he has clarified that Zakāt is distributed to the poor. This shows that none takes Zakāt except on the basis of poverty, and that the categories that are mentioned have only been mentioned as elaboration of the causes of poverty.”[9]

Al-Jaṣṣāṣ also says: “[The Prophet] has mentioned that the meaning/purpose based on which each one of the categories is entitled to [Zakāt] is poverty…As regards to the mention of [further] categories in the verse, it has come by way of explaining the causes of poverty. The proof of this is that the debtor, traveller and fighter are only entitled to it based on poverty and need and nothing else, showing that the factor based on which Zakāt is deserving is poverty.”[10]

A ḥadīth that apparently conflicts with the Ḥanafī understanding states: “Charity (i.e. Zakāt) is not permitted for a rich person except for five: one physically fighting in Allāh’s path, a collector, debtor, one who purchases it with his own money, or a person who has a poor neighbour to whom charity is given and the poor person gifts it to him.” Some Ḥanafīs have questioned the authenticity of this ḥadīth, while others have said that it refers to a fighter who owns more than the niṣāb amount (and is thus technically “rich”) but does not have it on his person and is cut-off from his wealth, and is thus legally poor.[11]

It is clear from these passages that in the Ḥanafī understanding, Zakāt is fundamentally a poor-due, and thus cannot be given to those who are not legally poor (fuqarā’). Thus, Ibn al-Humām (790 – 861 H) mentions that there is “consensus [in the Ḥanafī school] that all the categories besides the collector are given [Zakāt] on condition of poverty (faqr).”[12]

Purification of Zakāt Payers

From a spiritual and overall religious perspective, apart from the basic objective of submitting to divine will common to all ritual acts[13], the essential purpose of Zakāt is purification of oneself from sins and from the vice of attachment to wealth. Al-Sarakhsī (d. ca. 490 H) says: “The obligatory [payment] is only called ‘Zakāt’ because it purifies its owner from sins.”[14] Explaining why there is no Zakāt in a child’s wealth, Imām al-Qudūrī states: “Zakāt is for purification and a child is not qualified for purification as he has no need for it.”[15] “Zakāt” also has the meaning of “growth”, as the rewards of the people who give in Zakāt will grow with Allāh.[16]

Both aspects of Zakāt are referred to in the Qur’ān. The Qur’ān states: “Take from their wealth charity by which you will cleanse and purify them.” (9:103) The Qur’ān also says: “Whatever interest you give in order for it to increase in the wealth of people, it will not increase with Allāh, while whatever Zakāt you give, seeking thereby the pleasure of Allāh, these are the ones who are multiplying [their rewards].” (30:39)

Referring to the first verse above, Muftī Muḥammad Shafī‘ (1314 – 1396 H) explains: “An indication is found in [this verse] that Zakāt is not a government tax like that received in general governments for the running of the government system.[17] Rather, its purpose is to purify and clean the sins of the possessors of wealth themselves. Here, it is also worth reflecting that in reality there are two benefits to paying Zakāt. One is the benefit to the possessor of wealth himself, that by its means, he is cleansed of sins and the germs of the internal illnesses that arise out of greed and love for wealth; and the second benefit is that by its means the weak element of society is supported, who are incapable or fall short in providing for their own needs, like the orphans, poor women, disabled men and women and the general poor and needy…Zakāt is a monetary act of worship just like ṣalāh and fasting are bodily acts of worship.”[18] A similar explanation is found in al-Kāsānī’s (d. 587 H) Badā’i‘ al-Ṣanā’i‘.[19]

Moreover, Zakāt is described in ḥadīth as “people’s impurities”[20], and hence why the Banū Hāshim, on account of their nobility, cannot accept Zakāt money. In another ḥadīth, Zakāt is described as the “remnants of people’s sins.”[21] In other words, by giving Zakāt, payers are removing the uncleanliness and dirt of sin and attachment to wealth from their hearts.

Local Distribution

With regards to local distribution of Zakāt, Imām Muḥammad (132 – 189 H) states in al-Aṣl, the foundational document of the Ḥanafī school, that the poor of one’s locality has “more right” to receive Zakāt, but it is permissible to spend on the poor elsewhere.[22] It states in Mukhtaṣar al-Qudūrī: “It is disliked to transfer Zakāt from one town to another, but rather the charity of each people is to be distributed amongst them, unless an individual transfers it to his close relatives or to a people who are in more need of it than the inhabitants of his town.”[23] Al-Qudūrī (362 – 428 H) further states: “Our companions (Abū Ḥanīfah and his students) say: ‘It is better/superior (awlā)[24] to distribute Zakāt of each town to the inhabitants of the town, and for it not to be transferred from there unless it is to a people who are in more need of it or a man transfers his Zakāt to his blood relatives.’”[25] In fact, when people have relatives who are suffering, it is encouraged to spend on them rather than on those in one’s locality.[26]

This is based on the understanding that the reason for recommending distribution of Zakāt in one’s locality is physical nearness (jiwār)[27], and it is not based on anything intrinsic to the purpose of Zakāt. Because those in one’s locality enjoy nearness and closeness from a physical perspective, they have a greater right. Hence, this right will be superseded by the nearness of blood or anything that more effectively fulfils the legal purpose of Zakāt: alleviating the suffering of the needy. Al-Sarakhsī (d. ca. 490 H) explains: “Specifying the poor people of one’s town is not for any reason intrinsic to them, hence there is nothing inhibiting the permissibility/validity of distributing elsewhere, because that which is the purpose, which is fulfilling the need of the needy, is achieved.”[28]

Al-Sarakhsī reports from Imām Abū Ḥanīfah that he said: “When a possessor of wealth has needy relatives in another town, there is no problem with sending Zakāt to them, and this is [in fact] more rewarding for him as it entails maintaining family ties together with discharging his obligation.”[29]

With regards to the famous ḥadīth of Mu‘ādh, “take from their rich and return it to their poor”, several Hanafī scholars have interpreted the pronoun “their” as referring to “Muslims” in general, and not specifically to the people in the locality of Zakāt payers.[30] Based on the phrasing of one of Imām al-Bukhārī’s chapter titles, Ibn al-Munayyir argues that al-Bukhārī interpreted it in this way also.[31]

Burhān al-Dīn al-Bukhārī (551 – 616 H) explains: “Know that when the poor people of this town are equal in need to the poor people in another town, it will be spent on the poor people of this town and not on the poor people of another town and if it is spent on the poor of another town it is disliked. This is because the poor people of this town, when equal in need to the poor of another town, there is the observance of two rights when spent on the poor of this town: the right of the poor and the right of being a neighbour, while in spending on the poor of another town there is observance of one right only.”[32] He further says: “What we mentioned is when the poor of this town and the poor of another town are equal in need; but when the poor of this town are not in need or are in need but the poor of another town are more in need, spending on the poor of another town is better, because it is authentic that Mu‘ādh (raḍiyallāhu ‘anhu) would take Zakāt from the people of Yemen and send it to the Prophet (ṣallallāhu ‘alayhi wasallam) in Madīnah, and the Prophet (ṣallallāhu ‘alayhi wasallam) would distribute it amongst the Muhājirīn and Anṣār. Mu‘ādh would only do this because the poor of Madīnah were in greater need.”[33]

According to a narration in Ṣaḥīḥ al-Bukhārī, Mu‘ādh (raḍiyallāhu ‘anhu) would transfer some Zakāt funds to Madīnah. Ḥanafīs have used this narration to prove that it is permissible to transfer Zakāt elsewhere.[34] Abu l-‘Ᾱliyah (d. 93 H), the chief Qur’ān-teacher of Baṣrah in the time of the junior ṣaḥābah, would send his Zakāt to Madīnah.[35] It is also reported that ‘Aṭā’ ibn Abī Rabāḥ (26 – 114 H), the greatest scholar of Makkah in his time, would say: “They are all Muslims, so give it to wherever you like.”[36] Maymūn ibn Mihrān (40 – 127 H), a great imām of Kūfah, said: “It used to be recommended that Zakāt is dispatched to the children of the Muhājirin and Anṣār who are in Madīnah.”[37]

—-

The Ḥanafī position detailed above is a coherent and holistic reading of the principle purpose and legal philosophy of Zakāt. It would be important for those subscribing to the Ḥanafī school to keep this in mind in light of conflicting narratives that are being promoted. If paying through an organisation, Zakāt payers should ensure that the organisation is trustworthy, responsible and abides by the conditions required for valid payment of Zakāt.

Appendix: The Usage of Legal Stratagems (Ḥiyal) in Zakāt by Mufti Salman Mansoorpuri

For the valid payment of Zakāt it is necessary to grant ownership to the eligible poor person. Where granting of ownership (tamlīk) is not found – like [using the money for] buildings or public amenities – the discharging of Zakāt will not be valid. This is the default rule. However, the jurists have given scope for a stratagem (ḥīlah) via tamlīk (ḥīlah e tamlīk) in the situation of need:

“If one who owes Zakāt wants to shroud a deceased person using his Zakāt money, it is not permissible. A ḥīlah [to make this valid] is to donate it to a poor person from the family of the deceased and then he will shroud the deceased with it, and thus he will have the reward of charity and the family member of the deceased will have the reward of shrouding. Likewise, in all avenues of righteousness in which tamlīk does not occur, like building masjids, building bridges and hostels – it is not permissible to spend Zakāt in these avenues, although a ḥīlah [to make it valid] is to donate the amount of Zakāt to a poor person and then tell him thereafter to spend it on these causes, so the donor will have the reward of charity and the poor person will have the reward of building a masjid or bridge.” (al-Fatāwā al-Tatārikhāniyyah, 10:318)

Note: Here it should be remembered that a legal stratagem (ḥīlah) does not hold the position of a normal rule, but rather, as a last resort, it is permissible to employ a ḥīlah to fulfil a real need and to observe the limits of the law. Regarding ḥīlahs, the basic principle is that if a ḥīlah is employed to fulfil a goal of the Sharī‘ah, then there is scope for it without reprehensibility. But if ignoring the objectives of Sharī‘ah, a ḥīlah is employed, such a ḥīlah is extremely reprehensible. For example, if someone adopts a ḥīlah to waive the obligation of Zakāt from oneself, this is not permissible. However, if a ḥīlah is adopted to fulfil a religious need when there is no other option besides it, then that is permissible without any reprehensibility. For example, in some place, there is risk to the religion and faith of Muslim residents because of religious illiteracy, and it is difficult to establish a system of religious education with charitable donations apart from Zakāt, then in such a case of severe need it will be permissible to adopt the ḥīlah via tamlīk, and where it is possible to fulfil the need without a ḥīlah, ḥīlah via tamlīk will not be permissible:

“Our scholars have adopted [the view] that every ḥīlah which a man devises to nullify the right of another or to put doubt in it or to coat falsehood, it is reprehensible. According to al-‘Uyūn and Jāmi‘ al-Fatāwā it is not permissible. Every ḥīlah which a man devises to escape from ḥarām or in order to acquire ḥalāl, it is good.” (al-Fatāwā al-Tatārkhāniyyah, 10:313; Kifāyat al-Muftī, 4:285)

Nowadays carelessness in adopting ḥīlahs has increased, and generally ḥīlahs are given the status of a general rule! Thus, Zakāt funds are, without any concern, spent on non-recipients using the ḥīlah via tamlīk, and there is no concern towards such carelessness, while such a thing is very dangerous. The person involved in this should make a decision between himself and Allāh whether there really is a need for ḥīlah via tamlīk or not? If his conscience is satisfied then he may proceed, but otherwise it is necessary to refrain. (Maḥmūd al-Fatāwā, 3:48-56)

Kitāb al-Masā’il, 2:271-3

[1] There are strong indications that the delegation of Ḍimām occurred towards the end of the ninth year of Hijrah. Ibn Ḥajar mentions some of these indications. One such indication is that Ḥajj is mentioned in the ḥadīth as an obligation while Ḥajj only became obligatory in the ninth or tenth year of Hijrah. Ibn Qayyim al-Jawziyyah said: “When the obligation of Ḥajj was revealed, the Messenger of Allāh (Allāh bless him and grant him peace) hastened to Ḥajj without delay, since the obligation of Ḥajj was delayed to the ninth or tenth year.” (Zād al-Ma‘ād, Mu’assasat al-Risālah, 2:96) He further said: “The verse on the obligation of Ḥajj, ‘it is a duty on men to make pilgrimage to the House, those who find a means to it,’ was revealed at the end of the ninth year, the year of delegations.” (ibid. 3:520-1) Ibn Ḥajar thus said: “Hence, the truth is that Ḍimām’s arrival was in the ninth year, and this is what Ibn Isḥāq, Abū ‘Ubaydah and others were assured of.” (Fatḥ al-Bārī, Dār Ṭaybah, 1:271)

[2] See: Tuḥfat al-Fuqahā’, Dār al-Kutub al-‘Ilmiyyah, 1:299-30

[3] al-Aṣl, 2:142; Sharḥ Mukhtaṣar al-Ṭaḥāwī, Dār al-Bashā’ir al-Islāmiyyah, 2:373; al-Tajrīd, Dār al-Salām, 8:4216

[4] Radd al-Muḥtār, Dār ‘Ᾱlam al-Kutub, 3:288

[5] See: Awjaz al-Masālik, Dār al-Qalam, 6:77

[6] al-Tajrīd, 3:1356

[7] Tuḥfat al-Fuqahā’, 1:299

[8] al-Ikhtiyār, Dār al-Risālat al-‘Ᾱlamiyyah, 1:380

[9] Quoted in Awjaz al-Masālik, 6:77

[10] Sharḥ Mukhtaṣar al-Ṭaḥāwī, 2:380-1

[11] Al-Tajrīd, 8:4211; Badhl al-Majhūd, Dār al-Bashā’ir al-Islāmiyyah, 6:483

[12] Fatḥ al-Qadīr, Dār al-Kutub al-‘Ilmiyyah, 2:269; al-Nahr al-Fā’iq, Dār al-Kutub al-‘Ilmiyyah, 2:461

[13] Imām al-Shāṭibī states: “As for matters [in Sharī‘ah] of a ritual nature, the objective that is desired is mere submission without increase or decrease.” (al-Muwāfaqāt, Dār Ibn ‘Affān, 2:526)

[14] Al-Mabsūṭ, 2:149

[15] Al-Tajrīd, 3:1217

[16] Al-Mabsūṭ, 2:149

[17] The governmental nature of Zakāt, wherein the public wealth of Muslims would be forcibly taken by the government for Zakāt purposes, only began at around the eighth year of Hijrah, while Zakāt was an obligation for several years before this. This shows the governmental element of Zakāt is faciliatory, and not intrinsically linked to the real purpose of Zakāt.

[18] Jawāhir al-Fiqh, Maktabah Dār al-‘Ulūm Karāchī, 3:174-5

[19] Badā’i‘ al-Ṣanā’i‘, Dār al-Kutub al-‘Ilmiyyah, 2:373

[20] Ṣaḥīḥ Muslim, Maktabat al-Bushrā, 3:467

[21] Ṣaḥīḥ Ibn Khuzaymah, Dār al-Ta’ṣīl, 3:179

[22] Al-Aṣl, 2:140

[23] Quoted in al-Lubāb, Dār al-Bashā’ir al-Islāmiyyah, 2:363-4

[24] Based on the use of the word “superior” (awlā), Ibn ‘Ᾱbidīn deduces that the default reprehensibility of sending Zakāt elsewhere is of a light nature (makrūh tanzīhī). (Minḥat al-Khāliq in the margins of al-Baḥr al-Rā’iq, 2:269)

[25] al-Tajrīd, 8:4192

[26] al-Lubāb, 2:365

[27] al-Mabsūṭ, 2:180

[28] al-Mabsūṭ, 2:181

[29] ibid.

[30] al-Mabsūṭ, 2:203; al-Tajrīd, 8:4192; al-Baḥr al-Rā’iq, 2:269, Radd al-Muḥtār, 3:288

[31] Fatḥ al-Bārī, 4:351

[32] al-Muḥīṭ al-Burhānī, Idārat al-Qur’ān, 3:221

[33] ibid. 3:222

[34] al-Tajrīd, 8:4193

[35] Muṣannaf Ibn Abī Shaybah, Shirkat Dār al-Qiblah, 6:496

[36] ibid.

[37] ibid.

Leave A Comment